Zambia Reintroduces 15% Export Duty on Emeralds, Raising Concerns for Kagem Mining

The Zambian government has reinstated a 15% export duty on emeralds, effective 1 January 2025, under Statutory Instrument No. 88 of 2024.

This move ends a five-year suspension of the duty and significantly impacts Kagem Mining Limited, a key emerald producer in Zambia owned 75% by Gemfields and 25% by the Zambian Government’s Industrial Development Corporation.

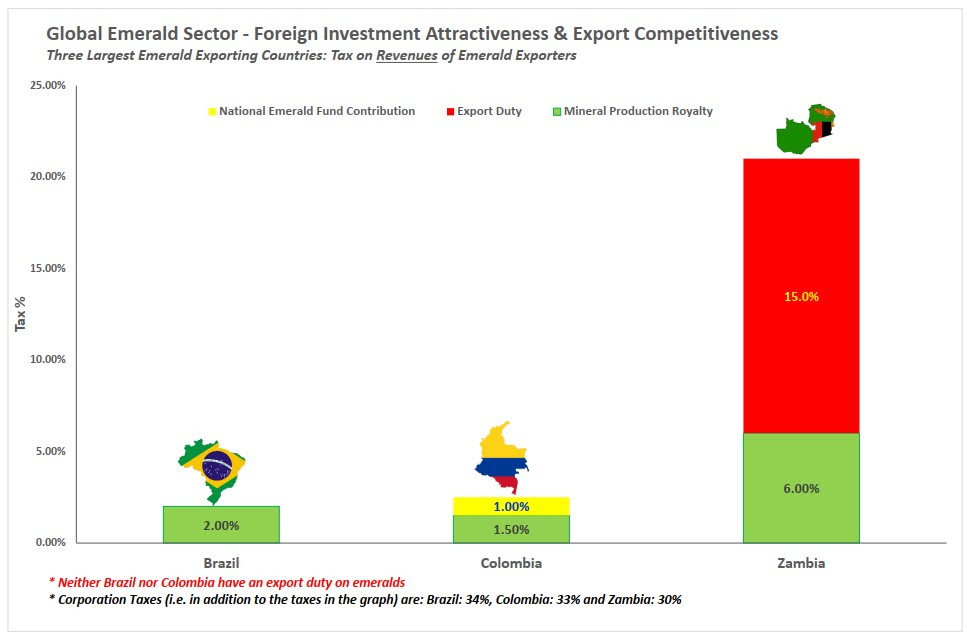

The 15% export duty is compounded by an existing 6% mineral royalty tax, bringing Kagem’s effective tax on revenues to 21%, excluding a 30% corporate tax. In comparison, major emerald-exporting nations Brazil and Colombia levy aggregate revenue taxes of 2% and 2.5%, respectively.

In 2023, with the export duty suspended, Kagem contributed 31% of its revenues to the Zambian government through taxes and dividends. However, the reinstatement of the duty has raised concerns about Zambia’s competitiveness and the sustainability of its emerald sector.

Gemfields expressed surprise at the lack of prior consultation and plans to engage the government to advocate for the suspension or removal of the duty.

Kagem Mining remains the world’s largest producing emerald mine, pivotal to Zambia’s gem industry. However, this development may affect sector investment and the country’s standing in the global emerald market.