SME Credit Guarantee Scheme to change Zambia’s businesses

Zambia is poised to usher in a transformative era for Small and Medium Enterprises (SMEs) with the imminent launch of a pioneering Credit Guarantee Scheme this year.

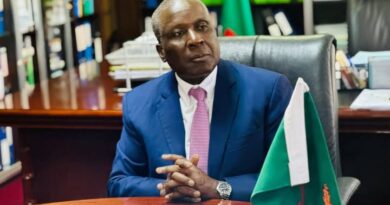

This marks a significant milestone for enterprise development in the nation, receiving acclaim from economic analyst Mr. Kelvin Chisanga, who hails it as a pivotal game-changer for SMEs and a catalyst for fostering robust economic activities.

The Credit Guarantee Scheme, outlined in the 2024 National Budget, emerges as a flexible and compelling solution to address capital challenges faced by SMEs in Zambia.

This development follows the launch of the SME policy in November 2023, an amendment of the 2018 policy, coinciding with the establishment of the Ministry of Small and Medium Enterprise Development in 2021.

Mr. Chisanga emphasizes the significance of the Zambia Credit Guarantee Scheme, originally slated for operationalization in 2023 but postponed by the Central Bank. The scheme now boasts a substantial budgetary allocation of around K300 million, with K150 million earmarked for the SME credit basket, aimed at guaranteeing and fostering enterprise development.

The remaining K150 million is allocated to an Agriculture Credit Window, designed to provide financial support to farmers. Under this initiative, farmers can borrow up to K70,000.00, facilitated by seven registered commercial banks.

This Credit Window operates concurrently with the Farmer Input Support Program (FISP), a well-established model targeting over 1 million farmers each marketing season.

Mr. Chisanga highlights the potential of the Agriculture Credit Window to complement existing programs, stating that graduates from FISP can leverage this credit facility to sustain their farming activities.

However, he notes a challenge in the lack of a comprehensive monitoring and evaluation mechanism for input-driven efforts, leaving the output subject to a broad policy framework.

In the realm of agriculture intervention, the Zambian government expends approximately 50% of the Ministry of Agriculture budget on subsidizing farmers at the input level and controls crop prices, including maize and soybeans, to ensure stability in the market.

The introduction of the SME Credit Guarantee Scheme aligns with Zambia’s commitment to fostering a conducive environment for economic growth and development, especially in the vital SME sector. The scheme is poised to stimulate entrepreneurship, drive innovation, and propel the nation towards sustainable economic prosperity.