Global Demand for Industrial Robots Doubles in a Decade, IFR Report Shows

Global demand for industrial robots has surged dramatically over the past decade, with installations more than doubling to reach 542,076 units in 2024, according to the World Robotics 2025 Report released by the International Federation of Robotics (IFR).

It marks the fourth consecutive year that annual installations have exceeded 500,000 units, underlining the rapid transition of industries worldwide towards digitalisation and automation. The total number of industrial robots in operation globally stood at 4.66 million units in 2024 – a 9% increase on the previous year.

“The new World Robotics statistics show 2024 recorded the second-highest installation count in history, only 2% below the all-time peak two years ago,” said Takayuki Ito, IFR President. “The transition into the automated age has driven a huge surge in demand.”

Asia accounted for 74% of new installations in 2024, far ahead of Europe (16%) and the Americas (9%). China remained the largest market, representing 54% of global deployments. With 295,000 new units installed – the highest ever recorded – China’s domestic manufacturers captured a 57% share of their home market, more than doubling from 28% a decade ago. The country’s operational robot stock surpassed 2 million units, the largest globally.

Japan retained second place with 44,500 installations, down slightly by 4%. The Republic of Korea recorded 30,600 installations, maintaining its position as the world’s fourth-largest robot market. India showed the fastest growth, reaching a record 9,100 units, driven largely by the automotive industry.

Europe installed 85,000 units in 2024, down 8% from 2023 but still the second-highest figure on record. Germany led with 26,982 units, followed by Italy (8,783), Spain (5,100), and France (4,900). The UK saw a sharp decline, with installations falling 35% to 2,500 units after the expiry of its “super-deduction” tax credit scheme in 2023.

Installations in the Americas reached 50,100 units, down 10% year-on-year. The United States accounted for 68% of these with 34,200 units installed, while Mexico (5,600) and Canada (3,800) followed. Automotive remained the leading sector across the region.

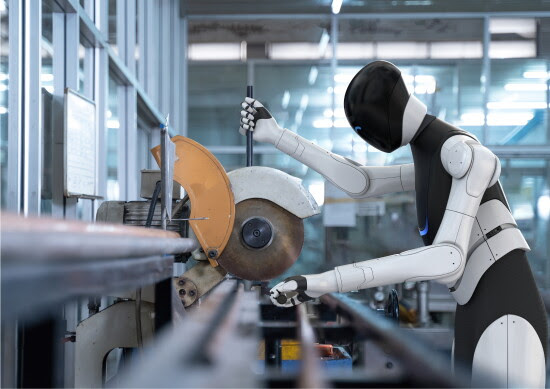

Alongside industrial robots, humanoid robots are gaining momentum. China has set explicit goals for mass production, while US and European tech firms are investing heavily. These general-purpose robots, designed to replicate human motion mechanics, are viewed as the next major leap in robotics. The IFR has released a new positioning paper on humanoid robots, available for free download.

Despite global economic uncertainty, including geopolitical conflicts and trade disruptions, the IFR projects continued growth in robotics. Global installations are forecast to rise by 6% in 2025 to 575,000 units and surpass 700,000 units by 2028.

“While regional trends differ significantly, the overall trajectory for robotics remains positive,” said Ito.