Airtel Money Partners with Premier Credit to Launch ‘KaFast’ Loan Service, Pioneering Financial Inclusion

Airtel Mobile Commerce Limited (Airtel Money) has joined forces with Premier Credit to introduce a new loan service named ‘KaFast’ accessible through the Airtel Money platform aimed at advancing financial inclusion.

The collaboration marks a significant milestone in the realm of financial accessibility, as eligible customers can now seamlessly acquire loans directly into their Airtel mobile money accounts, bypassing the conventional paperwork hassles associated with loan applications.

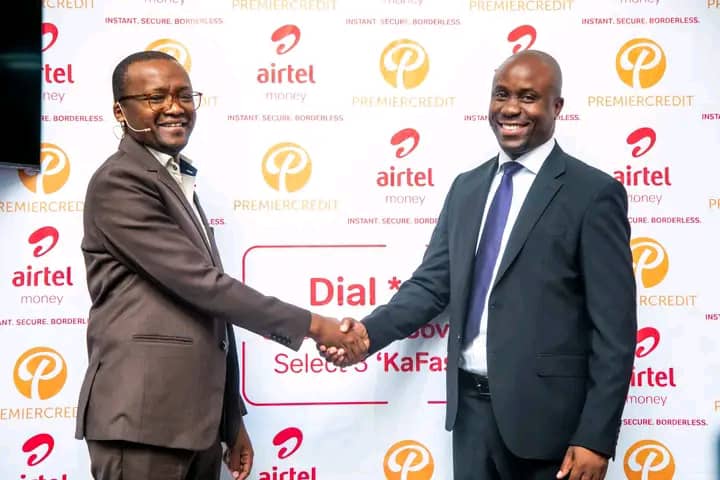

Andrew Chuma, Airtel Mobile Commerce Country Director, expressed the organization’s unwavering commitment to enhancing customer experiences on the Airtel Money platform.

He emphasized the partnership’s strategic importance in driving financial inclusion, leveraging both entities’ expertise and resources to empower individuals financially.

Vincent Malekani, Chief Executive Officer of PremierCredit, echoed similar sentiments, highlighting the launch of the KaFast loan as a pivotal step towards a future where access to financial assistance becomes a fundamental right rather than a privilege.

The KaFast loan service revolutionizes the loan acquisition process, allowing eligible clients to navigate seamlessly through their mobile devices.

From requesting loans to receiving disbursements, the entire process is streamlined, ensuring prompt and hassle-free financial assistance to those in need.

This innovative collaboration between Airtel Money and Premier Credit sets a new standard for convenience and efficiency in financial services, underscoring their shared commitment to driving financial inclusion and prosperity for all members of society.

With KaFast, the vision of a financially inclusive future takes a significant stride forward, promising greater accessibility and empowerment for individuals across the region.