IDTechEx Explores New Flow Battery Technologies Beyond Vanadium

Market intelligence firm IDTechEx has released new analysis highlighting the evolution of redox flow battery (RFB) technologies beyond vanadium, as the energy storage sector seeks cost-effective alternatives for large-scale and long-duration applications.

In a new report authored by Conrad Nichols, Principal Technology Analyst at IDTechEx, the firm notes that vanadium redox flow batteries (VRFBs) remain the most mature and commercially deployed RFB technology. VRFBs are valued for their long cycle life, energy efficiency of between 70 and 80 per cent, and the ability to independently scale power and energy capacity, making them suitable for long-duration energy storage.

However, IDTechEx observes that the high cost of vanadium electrolyte continues to restrict wider adoption of VRFBs, particularly as lithium-ion battery energy storage systems (BESS) benefit from declining costs and dominate the grid-scale market.

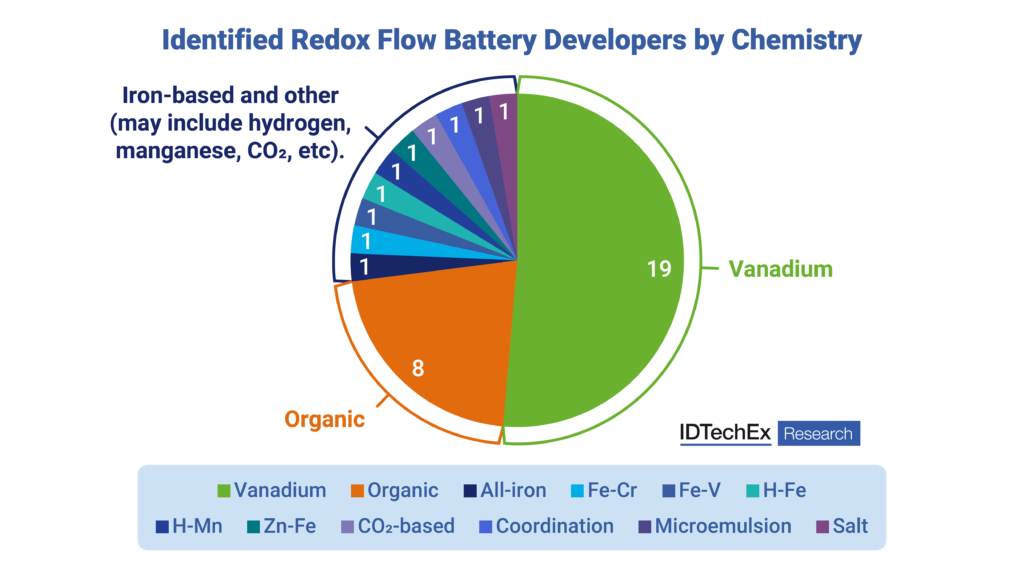

To address this challenge, developers are increasingly exploring alternative flow battery chemistries, including organic and iron-based technologies, which rely on cheaper and more abundant materials. According to IDTechEx’s latest market outlook, if these technologies achieve commercial viability, the global redox flow battery market could reach a value of US$9.2 billion by 2036.

The report further highlights that global vanadium supply remains constrained, with around 90 per cent currently consumed by the steel industry, leaving limited availability for battery applications. This imbalance has contributed to elevated VRFB system costs.

In response, electrolyte leasing models are beginning to emerge, reducing upfront capital costs for developers. In the United States, for example, Storion Energy is supplying vanadium electrolyte to Terraflow Energy for a 9.6 MW / 48 MWh VRFB project.

Despite these innovations, IDTechEx cautions that electrolyte leasing alone may not make VRFBs more cost-competitive than containerised lithium-ion systems in the near term. The firm suggests that new vanadium mining projects outside China, including in Canada and Australia, could play a critical role in easing supply constraints and lowering costs over the longer term.

Meanwhile, several companies are advancing non-vanadium flow battery technologies towards pilot and early commercial deployment. US-based Quino Energy is developing an organic flow battery using quinone-based electrolytes and is scaling production capacity, while Redox One, in partnership with Arxo Metals, is working to expand electrolyte production for its iron-chromium flow battery technology, targeting long-duration energy storage applications.

IDTechEx concludes that while vanadium-based systems are expected to dominate installations in the short term, alternative flow battery chemistries are likely to gain market share over time, particularly in applications where safety, longevity and long-duration storage offer advantages over lithium-ion technologies.

Further insights, including benchmarking of ten flow battery technologies, market forecasts, and analysis of key players and projects, are available in IDTechEx’s latest report, “Redox Flow Batteries Market 2026–2036: Forecasts, Markets, Technologies and Players”.