Global Commercial and Industrial Battery Storage Market Set to Hit US$21bn by 2036 – IDTechEx

The global commercial and industrial (C&I) battery storage market is projected to reach a value of US$21 billion by 2036, driven by the rapid expansion of renewable energy, data centres and electrification across key sectors, according to a new report by research firm IDTechEx.

In its latest study, Battery Storage for Data Centers, Commercial & Industrial Applications 2026–2036, IDTechEx says growing pressure on electricity grids is accelerating demand for battery energy storage systems (BESS), particularly beyond traditional grid-scale applications.

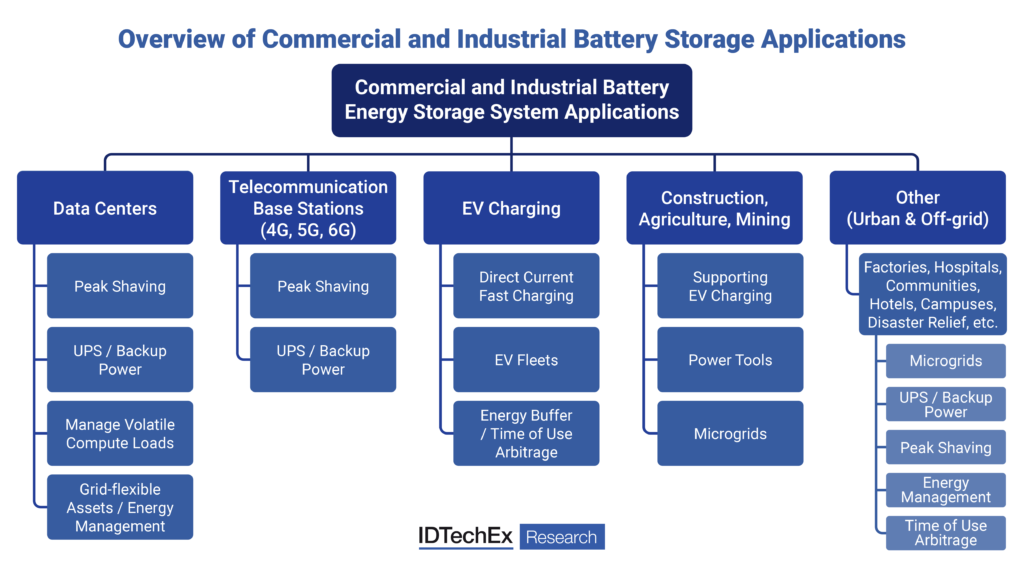

While lithium-ion technologies continue to dominate the energy storage market, IDTechEx notes that the C&I segment presents fresh opportunities for both established and emerging players. Demand is expected to rise across a wide range of applications, including data centres, telecommunications infrastructure, and electric vehicle (EV) charging for on-road and off-road uses such as construction, agriculture and mining.

The report highlights the United States as a key growth market, where the rollout of hyperscale data centres is expected to strain existing power infrastructure. This is likely to increase demand for larger-capacity and longer-duration battery storage systems to ensure grid stability and reliable power supply.

However, IDTechEx cautions that growth will not be limited to North America. Expanding 5G and 6G networks in China, increased adoption of on-site energy storage in European factories, and the electrification of heavy machinery in emerging markets are all expected to reshape global demand for C&I battery storage over the next decade.

Despite the current dominance of lithium-ion batteries, the report points to growing interest in alternative technologies due to concerns around safety, fire risk and degradation. For applications such as data centres, where batteries may be cycled frequently to manage volatile artificial intelligence workloads, technologies such as redox flow batteries could offer advantages due to their non-flammable electrolytes and longer operational lifespans.

IDTechEx also analyses competing technologies including sodium-ion batteries, second-life electric vehicle batteries and valve-regulated lead-acid systems, assessing their cost, performance and suitability for different C&I applications.

The report provides detailed 10-year market forecasts by region and application, alongside cost comparisons, technology benchmarks and profiles of more than 30 companies operating across the battery storage value chain.

According to IDTechEx, the evolution of the C&I battery storage market will depend on how well technology developers adapt to changing end-user requirements, particularly around cost, safety and durability, as the global energy transition accelerates.