AfDB Mobilises Stock Exchanges to Transform Africa’s Finance

The African Development Bank Group (AfDB) has launched a series of high-level consultations with African development finance institutions and private sector financial partners, aiming to create a historic blueprint for a New African Financial Architecture to bridge the continent’s development financing gap.

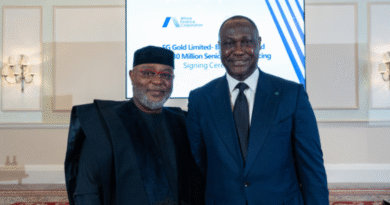

At the invitation of AfDB President Dr Sidi Ould Tah, over 50 representatives from regional and continental banks, development finance institutions, and investment funds convened at the Bank’s headquarters in Abidjan for two days of strategic discussions.

Speaking at the opening session with heads of African securities exchanges, private equity funds, and venture capital funds, Dr Ould Tah said: “As the architects of Africa’s capital markets, you are custodians of financial institutions and catalysts for our continent’s future.”

The meeting, the first of its kind between the Bank and African stock exchanges, focused on exploring their role in long-term financing and reforming capital mobilisation across Africa. Dr Felix Edoh Kossi Amenounve, CEO of the West African Regional Stock Exchange (BRVM), welcomed the initiative, stressing the need for reforms to mobilise capital from African pension funds, which were originally created to finance governments.

Represented at the consultations were leading financial institutions, including the African Exchange Linkage Project (AELP), Rwanda Stock Exchange, Mozambique Stock Exchange, Cabo Verde Stock Exchange, Nairobi Stock Exchange, Tunis Stock Exchange, BRVM, Central African Stock Exchange, Casablanca Stock Exchange, and Ghana Stock Exchange.

“The capital markets are the bedrock for long-term, sustainable economic growth,” Dr Ould Tah said, adding, “By mobilising patient capital, you provide sovereigns and businesses with diversified funding sources, while offering investors, particularly institutional investors, broader opportunities.”

A central goal of the consultations is to facilitate private equity and venture capital flows, strengthening African investment funds to finance small and medium-sized enterprises (SMEs), mid-market companies, and emerging industrial champions. SMEs, which account for nearly 90% of businesses and over 60% of jobs on the continent, continue to face limited access to risk capital.

The discussions also addressed sustainable finance, digitalisation of markets, investment attraction, and SME-targeted programmes. Developing financial literacy among young people, improving regulatory frameworks, and leveraging fintech solutions were highlighted as critical areas for future reforms.

Donald Waweru Wangunyu, Non-Executive Director of the Nairobi Stock Exchange, emphasised the need for regional coordination to scale up markets and implement reforms. Ms Sonia Ben Frej, Chairwoman of the Tunis Stock Exchange, highlighted the importance of updating outdated regulations and achieving regulatory convergence.

Dr Ould Tah outlined the Bank Group’s approach to capital market development, focusing on three pillars:

- Supporting regulatory authorities, stock exchanges, and intermediaries through technical assistance, institutional support projects, and policy-based operations.

- Diversifying savings mobilisation and market participants to enhance product liquidity and deepen markets for institutional investors and credit enhancement companies.

- Promoting research, training, and policy dialogue to strengthen the capacity of Africa’s capital market stakeholders.

“Capital markets development across Africa is a key priority and requires a collective effort from all stakeholders,” Dr Ould Tah stated.

The consultations will continue for a second day, engaging heads of African Development Financial Institutions to further advance the continent’s financial architecture and reduce dependence on overseas development assistance.