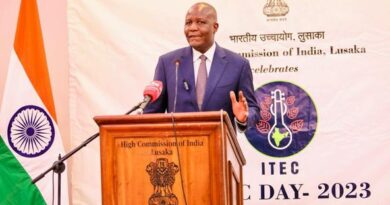

Governor Dr. Kalyalya Launches 2023 Banking Industry Survey Report

Bank of Zambia Governor Dr. Denny H. Kalyalya has launched the 2023 Banking Industry Survey Report by PwC, highlighting critical issues impacting Zambia’s financial sector. This eighth edition of the report provides insights into the state of the local economy, liquidity risk, and cybersecurity challenges facing the industry.

In his address, Dr. Kalyalya noted that the survey serves as a vital tool for stakeholders, including the Bank of Zambia. He commended PwC for their efforts and expressed gratitude to the survey participants for their cooperation.

Dr. Kalyalya discussed the current economic climate, referencing the recent Monetary Policy Committee (MPC) meeting. Despite maintaining the Monetary Policy Rate at 13.5%, inflation remains above the target range due to factors like the depreciation of the Kwacha and rising prices of essential goods and services.

The MPC’s decision to hold the rate steady was influenced by the need to balance inflation control with economic growth, especially in light of the recent drought and other challenges.

Addressing liquidity concerns, Dr. Kalyalya explained the Bank of Zambia’s strategies to manage inflation and exchange rate pressures.

Measures included raising the Statutory Reserve Ratio and instructing government deposits to be transferred to the Bank of Zambia. The bank also adjusted its approach by using Overnight Lending Facilities and Open Market Operations to stabilize liquidity.

Cybersecurity was highlighted as a major concern due to the growing reliance on digital banking solutions. Dr. Kalyalya outlined the Bank of Zambia’s new 2024-2027 Strategic Plan, which focuses on enhancing cybersecurity and resilience in the financial sector.

Initiatives include establishing the Financial Sector Cyber Incident Response Team (FINCIRT) and implementing new Cyber and Information Risk Management Guidelines.

Despite challenges, the banking sector remains resilient, with adequate capital and satisfactory asset quality. Dr. Kalyalya emphasized the sector’s continued ability to generate income, fund growth, and maintain stability, though ongoing assessments will address asset quality concerns.

Dr. Kalyalya concluded by reiterating the importance of concerted efforts from all stakeholders to support the sector’s stability and growth.