NamRA Collects N$275.8 Billion in Five Years with AfDB Backing

Support from the African Development Bank Group has significantly strengthened Namibia’s tax administration capacity, resulting in a major surge in domestic revenue mobilisation. In under five years, the Namibia Revenue Agency (NamRA) has collected N$275.80 billion, representing a 67 percent increase in revenue since the agency was established.

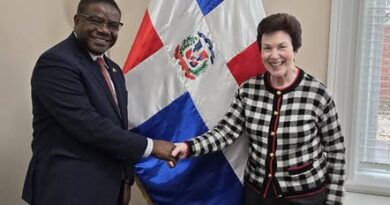

NamRA Commissioner Sam Shivute credited the milestone to the Bank’s multi-year budget support and technical assistance. “Without the African Development Bank’s support, the agency may not have achieved this milestone,” he said during a Bank supervision mission in Windhoek on Tuesday. “The agency aspires to be a world-class organisation, and our annual domestic revenue mobilisation has been growing consistently, exceeding expectations.”

The Bank played a pivotal role in establishing NamRA through a series of budget support operations between 2017 and 2022, and continues to provide technical assistance to improve Namibia’s public finance management and economic governance.

On 17 December 2024, the Bank approved a US$342,000 Middle Income Country Technical Assistance Fund Grant to finance the Namibia Tax Administration Technical Assistance Project.

The project aims to enhance revenue collection through:

- specialised audits in key economic sectors,

- capacity building for NamRA staff, and

- strengthened data analytics and risk profiling.

These reforms are expected to reduce revenue leakages, improve fiscal sustainability, and create space for greater public investment in economic and social sectors.

Baboucarr Koma, Chief Governance Officer at the African Development Bank, who led the supervision mission, said the initiative reflects a broader continental effort to reduce reliance on external aid.

“As official development assistance declines, the Bank has been supporting African countries in strengthening domestic revenue mobilisation,” he said. “By strengthening NamRA’s institutional capacity, the Bank is not only closing revenue leakages but also enhancing fiscal space and laying the foundation for sustainable economic development and improved quality of life for all Namibians.”

Namibia remains one of Africa’s strongest tax performers. According to the African Tax Administration Forum’s African Tax Outlook 2023, the country recorded a tax-to-GDP ratio of 26.2 percent, significantly higher than the continental average of 15.1 percent.

Officials from the Ministry of Finance and Public Enterprises said improved revenue mobilisation would allow government to invest more in infrastructure, social services and long-term development while maintaining fiscal discipline.

Established in 2021 under the Namibia Revenue Agency Act, NamRA is responsible for tax assessment and collection on behalf of the State.

Koma said the Bank’s partnership with Namibia demonstrates how technical support can help drive transformative change. “This partnership sets a benchmark for tax administration reform across Africa,” he added.