BII, NAPSA and Swedfund Launch $70M GIP Zambia to Bridge SME Financing Gap

British International Investment (BII), Zambia’s National Pension Scheme Authority (NAPSA), and Swedish development financier Swedfund have officially launched Growth Investment Partners Zambia (GIP Zambia), a new investment company aimed at transforming access to capital for small and medium-sized enterprises (SMEs) across the country.

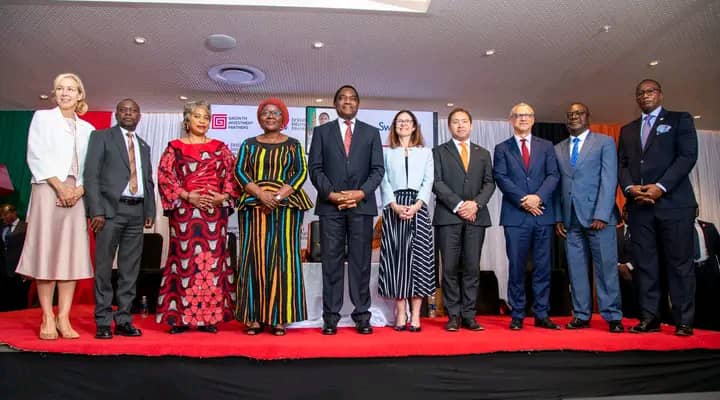

The initiative begins with an initial capital commitment of $70 million, featuring $37.5 million from BII, $17.5 million from NAPSA, and $15 million from Swedfund. The launch event in Lusaka was officiated by Zambian President Hakainde Hichilema, who reaffirmed the government’s commitment to fostering private-sector growth and inclusive economic development.

GIP Zambia is designed to address a long-standing financing gap in the SME sector, which accounts for over 70 percent of Zambia’s GDP and 88 percent of employment. Many SMEs face barriers to accessing capital due to limitations in traditional banking systems and private equity models. GIP Zambia will provide long-term, flexible financing primarily in local currency, with features such as longer tenors, reduced collateral requirements, and tailored repayment arrangements.

Speaking at the launch, BII CEO Leslie Maasdorp highlighted the potential of Zambia’s SMEs to drive inclusive growth and job creation. He emphasized that GIP Zambia builds on BII’s successful experience in Ghana and reflects a long-term commitment to supporting local entrepreneurs with the right kind of capital.

Shipango Muteto, Chairperson of NAPSA’s Board of Trustees, described the initiative as both a strategic investment and a national imperative. He stated that investing in SMEs not only stimulates economic activity but also contributes to the growth and sustainability of the pension fund.

Swedfund’s Chief Investment Officer Marie Aglert noted that the partnership offers an opportunity to support SMEs through patient, local currency financing tailored to their unique challenges and potential.

GIP Zambia CEO Musonda Chipalo stressed the company’s mission to provide practical financing solutions that reflect the realities of local businesses. He stated that GIP Zambia aims to empower entrepreneurs to grow sustainably and create jobs that strengthen the national economy.

The investment platform is expected to support more than 150 SMEs over the next 15 years and deploy over $300 million, with a strong focus on key growth sectors such as agriculture, manufacturing, and financial services. Special emphasis will also be placed on supporting women-led and locally owned businesses.

British High Commissioner to Zambia Rebecca Terzeon praised the launch as a milestone in UK-Zambia cooperation. She expressed confidence that the initiative will deliver real economic transformation while reinforcing Zambia’s long-term development goals under Vision 2030 and the 8th National Development Plan.

GIP Zambia demonstrates a scalable and replicable model for SME financing across Africa, positioning Zambia at the forefront of innovative financial solutions that support entrepreneurship and economic resilience.