SCBL Leads Gains as LuSE Posts Marginal Weekly Rise Amid Low Turnover

The Lusaka Securities Exchange (LuSE) posted a marginal week-on-week gain in the latest market performance, as the All Share Index (LASI), excluding ZCCM-IH, rose by 0.22% to close at 20,567.22 points. However, trading activity dipped sharply, with turnover falling to ZMW 5.66 million (USD 238,630) from ZMW 24.15 million (USD 1.02 million) recorded the previous week.

Market leader in turnover was Copperbelt Energy Corporation (CECZ), which contributed 29.40% of the total turnover. Meanwhile, the only listed Real Estate Investment Trust (REIT), REIZUSD, recorded a turnover of USD 2,347.51 (ZMW 55,560) from 26,089 units traded, though no price movement was recorded.

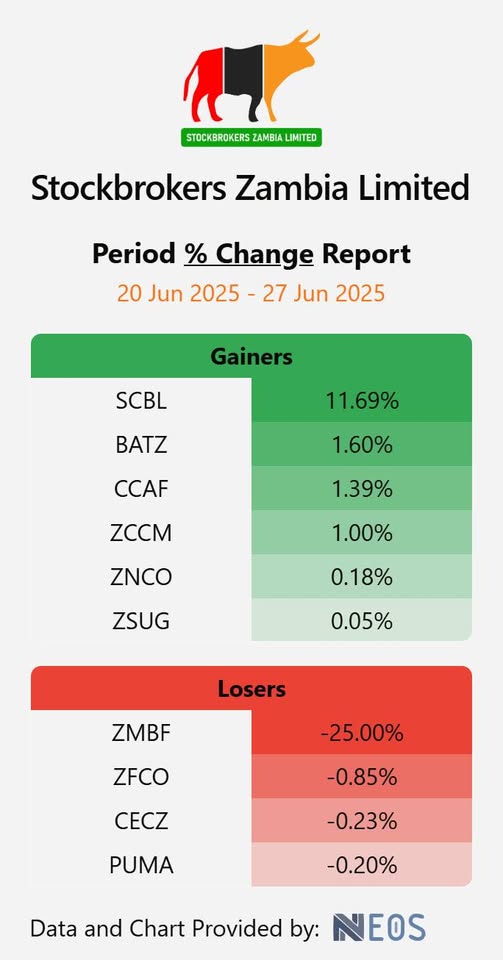

Standard Chartered Bank Zambia (SCBL) emerged as the top gainer of the week, posting an 11.69% rise to ZMW 2.77. Other gainers included British American Tobacco Zambia (BATZ), which edged up 1.60%, and ZCCM-IH with a modest 1.00% gain. On the flip side, Zambeef Products (ZMBF) was the biggest loser, falling 25% to ZMW 2.25. PUMA Energy also slipped slightly by 0.20% to ZMW 4.99.

On the forex front, the Zambian Kwacha depreciated against all major currencies. It weakened by 4.40% against the Euro, 4.17% against the British Pound, 3.41% against the South African Rand, and 2.44% against the US Dollar, reflecting continued pressure on the local currency.

Zambeef released its half-year financial results, reporting ZMW 3.8 billion in revenue and ZMW 1.4 billion in gross profit—a 12.5% and 26.2% rise, respectively. The group’s operating profit surged 28% to ZMW 247.7 million, underscoring resilient business performance despite economic headwinds.

ZCCM-IH issued a cautionary notice due to a court petition filed by Hon. Miles Sampa challenging the legality of the Mopani Copper Mines transaction. The company also announced its 21st Annual General Meeting (AGM) scheduled for July 18, 2025, and published its 2024 audited financial results, which showed a profit of ZMW 39.85 billion largely attributed to the Mopani deal.

Standard Chartered Bank Zambia issued a further cautionary regarding the ongoing evaluation of options to sell its Wealth and Retail Banking division. Meanwhile, ZAFCO PLC confirmed plans for a rights issue to fund forestry expansion and land restoration projects.

The 364-day Treasury Bill yield remained at 14.50%, while the monetary policy rate also held steady at 14.50%. Year-on-year inflation dropped marginally by 0.01% to 15.30%. Bond yields on the 5-year government security remained unchanged at 16.55%.

As market volatility persists, investors are urged to stay informed and exercise caution amid changing macroeconomic conditions and ongoing corporate actions. With significant corporate disclosures expected and macro indicators under pressure, investor sentiment is likely to remain mixed in the coming weeks.