ZACCI Calls for Overhaul of Tax System to Boost Formalization and Revenue Efficiency

The Zambia Chamber of Commerce and Industry (ZACCI) has highlighted systemic inefficiencies within the current tax framework, including limited taxpayer education and outreach by tax authorities across the country.

ZACCI Research and Information Officer Emmanuel Mumba said this also includes the macroeconomic implications of a large informal economy coupled with fragmented data systems, frequent Zambia Revenue Authority (ZRA) technical downtimes.

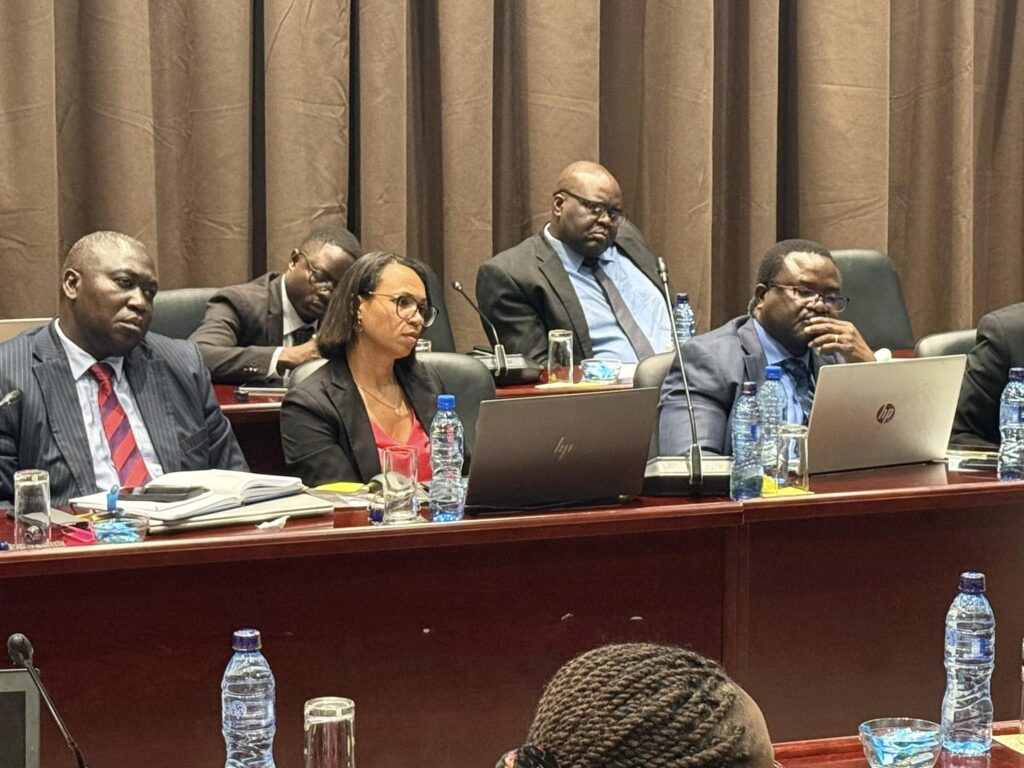

Mumba said this in Lusaka when ZACCI participated in the Revenue Collection Delivery Lab convened by the Presidential Delivery Unit (PDU) from May 12 to May 13 2025.

He underscored that addressing the structural bottlenecks was critical to expanding the formal tax base, enhancing compliance behavior, and fostering trust in fiscal institutions.

“The Lab served as a high-level policy dialogue platform, bringing together critical stakeholders, including Permanent Secretaries, the Commissioner General of the ZRA, the Public-Private Dialogue Forum (PPDF), PDU,” Mumba noted.

Additionally, Think Tanks, Civil Society Organizations(CSOs), and Private Sector Institutions such as the Zambia Association of Manufacturers (ZAM).

He further outlined ZACCI’s flagship formalization agenda, implemented in collaboration with the Industrial Development Corporation (IDC), as a strategic lever to transition informal enterprises into the formal economy.

Mumba stated that this had stimulated productive capacity, improving tax buoyancy and supporting private sector-led economic transformation.

“ZACCI remains committed to supporting policies that promote formalization and advance a fair, predictable, and inclusive tax environment conducive to private sector development,” he said.

Mumba noted that the primary economic objective of the Delivery Lab was to co-develop actionable strategies to enhance domestic revenue mobilization by broadening the tax and non-tax revenue base.

He said the other objective was to find actionable strategies aimed at curbing fiscal leakages and improving the technical and institutional efficiency of tax administration systems.

“This aligns with Zambia’s fiscal consolidation agenda underpinned by sustainable public finance management and inclusive growth,” Mumba said.