IMF and Ukraine Reach Staff-Level Agreement on Fourth Review of Extended Fund Facility Arrangement

The International Monetary Fund (IMF) staff and Ukrainian authorities have reached a staff-level agreement on the fourth review of the four-year Extended Fund Facility (EFF) Arrangement. This agreement, if approved by the IMF Executive Board, will allow Ukraine access to approximately US$2.2 billion (SDR 1,669.82 million).

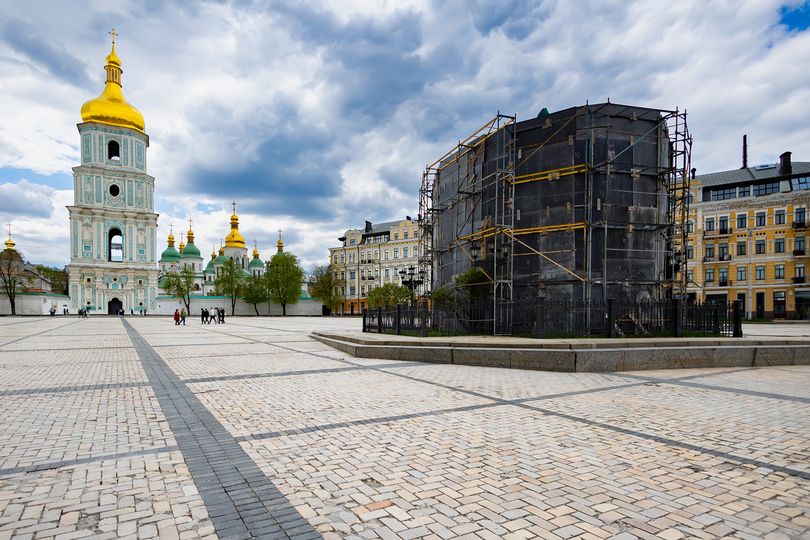

During the discussions held in Warsaw from May 27-31, 2024, and in Kyiv on May 23-24, 2024, IMF staff and Ukrainian officials reviewed Ukraine’s economic performance under the EFF. Led by Mr. Gavin Gray, the IMF team acknowledged Ukraine’s resilience amid ongoing war and economic challenges. Mr. Gray praised the country’s strong economic performance, noting that all quantitative performance criteria were met, and structural benchmarks were either met or delayed briefly.

“Ukraine’s four-year EFF Arrangement with the IMF, part of a US$122 billion international support package, continues to be a critical anchor for the country’s economic stability amidst high uncertainty,” Mr. Gray stated. “Despite the devastating impacts of over two years of war, Ukraine has maintained macroeconomic and financial stability through skillful policymaking, the adaptability of its households and firms, and significant external financing.”

The Ukrainian economy exhibited resilient growth and disinflation in the first quarter of 2024, supported by adequate foreign exchange reserves. However, as the war continues, risks are escalating, with economic activity expected to slow in the latter half of 2024 due to large-scale attacks on the energy sector and war-related confidence effects. Inflation is projected to rise moderately during this period.

Ukraine faced liquidity strains earlier in the year due to delays in external financing. Nevertheless, budget support for 2024 has resumed, aiding in economic stability. The fiscal financing needs remain substantial, requiring budget execution to align with financing constraints and efforts to restore fiscal and debt sustainability. Progress is being made toward restructuring commercial external debt, which is vital for high-priority expenditures and sustainable debt levels. The 2025 Budget will necessitate measures to boost domestic revenue, given elevated spending needs.

The IMF mission emphasized the need for continued monetary policy easing, given the well-anchored inflation expectations, and the importance of the exchange rate acting as a shock absorber. The National Bank of Ukraine’s strategy for liberalizing foreign exchange controls should proceed cautiously to preserve macroeconomic stability and support recovery.

To ensure fiscal sustainability, accelerating tax policy and revenue administration reforms under the National Revenue Strategy is crucial. Strengthening tax and customs administration, enhancing public trust through anti-corruption measures, and adopting robust legislative reforms to address major economic crimes were highlighted as priorities.

Ukraine’s commitment to structural reforms, EU accession, and governance enhancement remains strong. Critical governance and anti-corruption reforms include strengthening the criminal procedural code, creating a new high administrative court, and completing an external audit of the National Anti-corruption Bureau.

Monitoring fiscal risks from state-owned enterprises and the energy sector is essential to ensure prudent public spending and debt sustainability. Strengthening fiscal risk assessment and implementing the new SOE corporate governance law are also important.

The financial sector remains stable and liquid, with ongoing reforms despite challenges under Martial Law. Priorities include enhancing bank resolution, supervision, and financial inclusion, especially in conflict-affected areas.

The IMF mission, which met with Finance Minister Serhiy Marchenko, National Bank of Ukraine Governor Andriy Pyshnyy, and other senior officials, expressed gratitude for their cooperation and constructive discussions. The IMF Executive Board is expected to consider the agreement in the coming weeks.