Zambia Announces Landmark Debt Restructuring Agreement

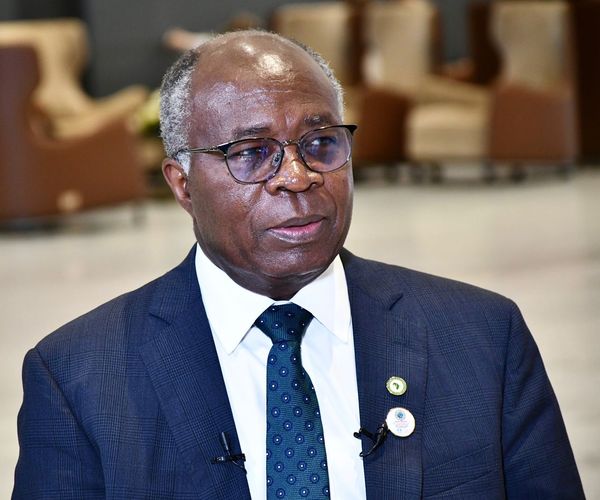

Minister of Finance & National Planning, Dr. Situmbeko Musokotwane, MP, has announced a breakthrough agreement between Zambia and the steering committee of the adhoc creditor committee of Zambia’s Eurobond Holders.

Addressing the House on Monday, 25th March 2024, Dr. Musokotwane highlighted the milestones achieved in Zambia’s debt restructuring journey, including the previous agreements with bilateral creditors under the Official Creditor Committee (OCC).

These agreements, reached in June 2023 and formalized in October 2023, laid the groundwork for further negotiations with private and commercial creditors, particularly holders of Zambia’s Eurobonds.

After months of rigorous negotiations, Dr. Musokotwane confirmed that Zambia and the Steering Committee have reached an agreement on the key commercial terms of a proposed restructuring transaction relating to Zambia’s Eurobonds due in 2022, 2024, and 2027.

This agreement, endorsed by the OCC and the International Monetary Fund (IMF), complies with the Comparability of Treatment principle and debt sustainability targets under the IMF program.

The restructuring agreement involves the issuance of “New Bonds,” comprising Bond A and Bond B, totaling US $3.05 billion. These bonds come with adjustment mechanisms linked to Zambia’s future economic performance, providing flexibility and ensuring alignment with IMF requirements.

Under the agreement, Bondholders will forego approximately USD 840 million of their claims through a haircut on the outstanding balance and provide approximately USD 2.5 billion in cash flow relief through reduced debt service payments during the IMF program period.

Dr. Musokotwane emphasized that the agreement signifies a significant step forward in Zambia’s debt restructuring efforts, with approximately 75% of the debt subject to restructuring now successfully restructured.

He also highlighted the positive impact of the agreement on Zambia’s economy, including increased confidence and potential for foreign direct investment.

While acknowledging the progress made, Dr. Musokotwane reiterated the need for expedited bilateral agreements with official creditors and continued engagement with other commercial creditors to achieve comprehensive debt treatment.

In conclusion, Dr. Musokotwane expressed gratitude to creditors and stakeholders for their support and reaffirmed the government’s commitment to restoring long-term debt sustainability and achieving sustainable economic growth.