Zambia Launches Smart Invoice System to Revolutionize Tax Administration

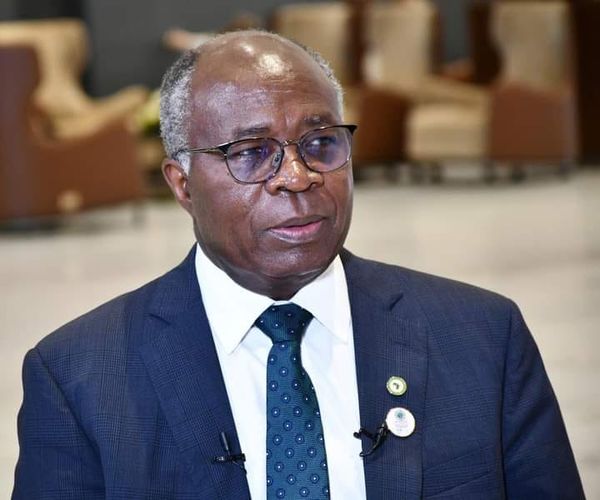

Minister of Finance and National Planning, Hon. Dr. Situmbeko Musokotwane, inaugurated the groundbreaking Smart Invoice System Initiative. This innovative tool marks a pivotal moment in Zambia’s journey towards modernizing tax administration, boosting domestic revenue collection, and fostering economic growth.

The Smart Invoice System, unveiled amidst accolades from various quarters, is hailed as a significant milestone in the government’s efforts to revamp tax administration and ramp up revenue collection.

The initiative, a product of collaboration between the Governments of Zambia and Rwanda under an existing memorandum of understanding, underscores the power of South-to-South cooperation in driving technological advancements.

Expressing gratitude to the Zambia Revenue Authority (ZRA) and the Rwanda Revenue Authority (RRA) for their instrumental roles, Dr. Musokotwane emphasized the system’s role in fortifying the nation’s fiscal health.

With ambitions to elevate tax revenue contributions to over 90%, the Smart Invoice System is poised to fuel essential public services such as healthcare, education, infrastructure development, and public safety.

Furthermore, the initiative symbolizes the government’s commitment to rely more on domestic revenue, signaling a shift away from excessive borrowing.

Dr. Musokotwane highlighted the successful implementation of key provisions outlined in national budgets, including initiatives like free education and an augmented Constituency Development Fund (CDF) allocation aimed at grassroots empowerment.

The increase in CDF allocation from k1.6 million in 2021 to k30.8 million in 2024 reflects the government’s dedication to fostering equitable development across all constituencies.

Leveraging electronic invoicing, the Smart Invoice System seeks to digitize the invoicing process, replacing archaic paper-based methods with real-time electronic transmission to revenue authorities.

Expected to streamline VAT and other transactional tax types, the system aims to bridge revenue collection gaps and emulate the successes witnessed in peer countries like South Africa and Rwanda.

Real-time reporting and monitoring capabilities promise swift identification of discrepancies and potential tax evasion instances, offering businesses a smoother compliance journey while sealing revenue leakages.

In essence, the Smart Invoice System embodies the government’s pledge to enhance administrative efficiency, foster transparency, and curb revenue leakages, ultimately propelling Zambia towards a more robust fiscal future.

The launch of the Smart Invoice System heralds a new era of tax administration in Zambia, one characterized by innovation, efficiency, and fiscal responsibility. As the nation embarks on this transformative journey, the echoes of progress resonate across sectors, promising a brighter economic horizon for generations to come.